FinCEN Requires Austin, TX Businesses to File BOI Reports by 01/01/2025—Avoid $500 Daily Penalties

The Corporate Transparency Act (CTA) mandates specific businesses in Austin, TX to disclose Beneficial Ownership Information (BOI) to FinCEN, aiming to combat financial crimes like tax evasion and money laundering.

As of today, 11-26-2024, Austin business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—don’t delay, as penalties of $500 per day may apply!

Steps to Ensure Compliance

1. Determine If Your Business Must File

Deadline: ASAP

Businesses like corporations, LLCs, and other entities in Austin likely need to file unless exempt (e.g., banks or nonprofits).

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners are individuals who either:

-

Own 25% or more of the business, or

-

Control its operations or decisions.

3. Gather Required Information

Deadline: 12-17-2024

You’ll need:

-

Business details: Name, EIN, address

-

Owner details: Names, addresses, birthdates, and ID information

4. File the BOI Report

Deadlines:

-

Companies formed before 2024: 01/01/2025

-

New companies (2024): 90 days after formation

-

New companies (2025+): 30 days after formation

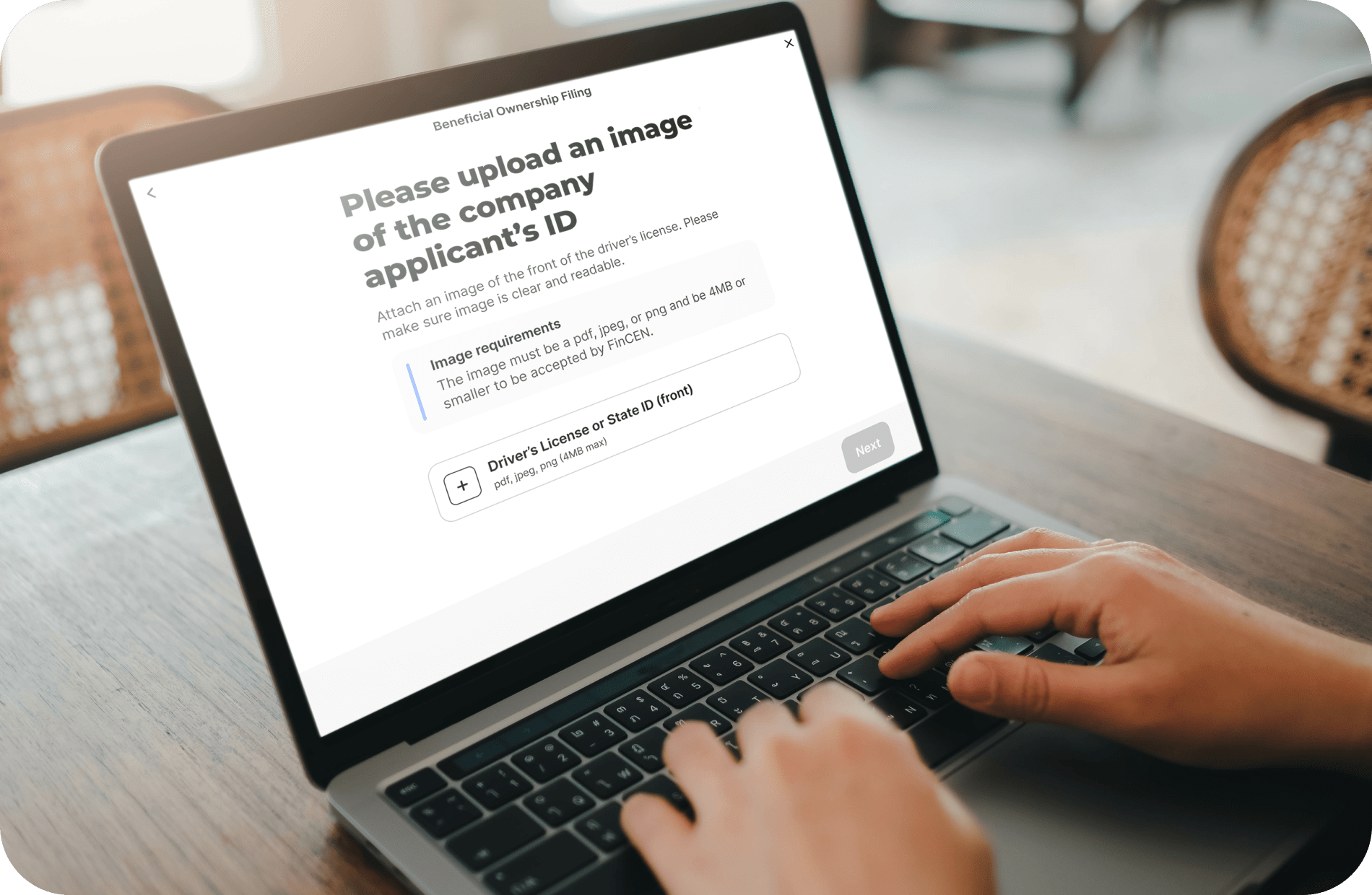

ZenBusiness can help simplify your BOI filing process—click here to learn more.

Key Information About BOI Filing

Who Needs to File?

Corporations, LLCs, and similar entities are required to file unless exempt. For example, a local Austin technology startup operating as an LLC must submit a BOI report.

What Is a Beneficial Owner?

A beneficial owner either:

-

Has substantial control (e.g., decision-making power), or

-

Holds 25% or more ownership.

For instance, if two partners own a small café in Austin, each holding a 50% stake, both qualify as beneficial owners.

What Information Is Needed?

To file, businesses must provide:

-

Company details: Name, address, EIN

-

Owner details: Full names, addresses, birthdates, and government-issued ID numbers

How to File

BOI reports must be submitted electronically via FinCEN’s system. Deadlines vary based on the business formation date:

-

Formed before 2024: 01/01/2025

-

Formed in 2024: 90 days after formation

-

Formed in 2025+: 30 days after formation

Penalties for Non-Compliance

Failure to file or providing false information can lead to penalties of $500 per day and possible imprisonment. A 90-day safe harbor period allows corrections for mistakes made in good faith.

ZenBusiness: Your BOI Filing Partner

ZenBusiness offers expert assistance to ensure your BOI report is accurate and submitted on time. Save time, avoid fines, and focus on your business with their easy filing process. Learn more by clicking here.

Additional Resources

Prepare your Austin business for the January 1, 2025, BOI filing deadline—start today!

Your input makes a difference! Take a few minutes to complete our BOI survey by December 18, 2024, and for every 25 responses, our Chamber will receive a $100 donation. [Take the survey here!] Thank you for supporting our Chamber and sharing your feedback!

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.

ZenBusiness

-

Sallie Clark Marketing Coordinator

- November 26, 2024

- (512) 765-4985

- Send Email